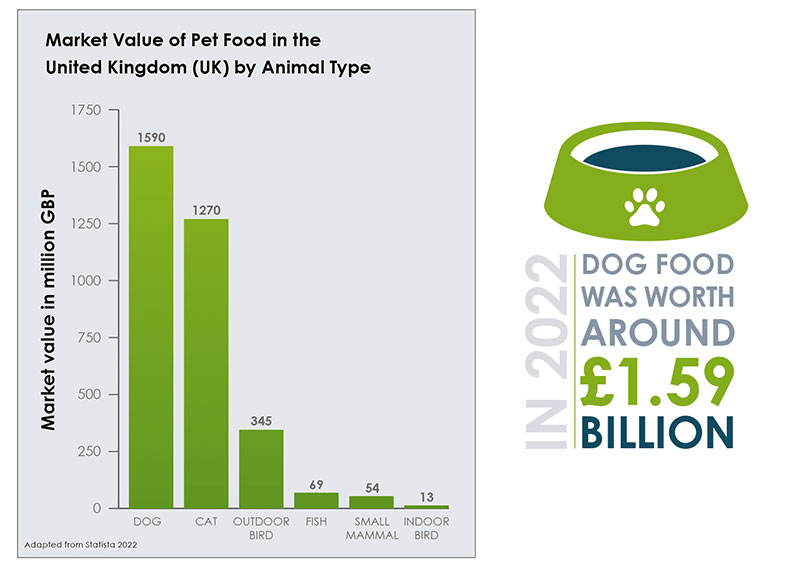

Just leaf through this brochure and you will come to conclusion that dog food is the biggest market segment for pet trade. It was worth around £1.59 billion in the UK in 2022. This category tends towards consolidation in that it is dominated by a few key players. New entrants in recent years have often used a subscription direct to consumer model, with some of those brands being bought up by larger manufacturers.

The good news is that overall value is still predicted to continue to increase by 20% over the next five years and the sector as a whole continues to outpace general FMCG.

According to Mintel, volume sales are expected to decline across pet-food with an increasing move from wet to dry, especially in the cat category, due to concerns over the cost of living. However, previous data has shown that the least affluent shoppers spend more on wet food, whereas the most affluent spend more on dry food, so it will be interesting to see if this switch does occur at the lower end of the market, particularly given that the price per pack is often higher in dry which represents a barrier for less well-off shoppers.

As more people work from home, smaller, top up shops might also mean that the convenience sector takes more market share. Specialist retailers who can capitalise on the benefits of local shopping, especially for home workers, may also benefit from this trend. On dog, the evidence is that a pet-food purchase is often made on impulse in convenience, suggesting that merchandising can be key, even in this brand loyal sector.

Overall in specialist, there are more dog owners, making more visits but spending less. Categories that are especially strong on dog-food right now across sectors, are wet multi-serve, dry, and wet single serve, while cat is slightly in decline – in other words dog is driving much of the growth. Dry continues to be the strongest category for specialist, suggesting that wet dog lines which are well merchandised to capture impulse sales could offer an opportunity to increase basket fill.

Much of the innovation we have seen in 2022 has been in wet dog, with new varieties and brands emerging.

The good news is that overall value is still predicted to continue to increase by 20% over the next five years and the sector as a whole continues to outpace general

fast-moving consumer goods (FMCG).

Nutrition and key market drivers

One of the biggest long-term concerns is the number of pet owners seeking to make their pet’s food, often with very little nutritional knowledge and with the potential for nutritional deficiencies to emerge over time. Issues around ingredient transparency have partly driven this trend, as well as a desire to feed a diet that more naturally mimics a dog’s ancestral diet. This has fuelled the move towards raw, often with recognisable cuts of meat being offered.

Local sourcing, Made in Britain, traceability, sustainability, plant based diets and the inclusion of ‘superfoods’ are all said to be important drivers of consumer shopping behaviour in this sector. It remains to be seen whether there will be a backlash against the use of premium/ human grade ingredients on the grounds of being environmentally damaging. In the past, the use of less attractive cuts and offal has allowed pet-food to be produced at an affordable price point and enabled

the use of a significant amount of the whole carcase after slaughter for human consumption.

Alternative protein pet-food, such as insect-based brands are starting to emerge, but price and acceptability remain a barrier. Less than 1% of all pet-food brand launches worldwide are insect-based foods. Organic brands have been tipped for long term success and generation Z and millennials have been identified as the most willing to pay 20% more for sustainable products for their adult pets.

Obesity continues to pose significant issues for dogs despite an increase in education around the problem. In general, pet owners appear to fail to recognise when their pet is overweight, and this is likely to be a barrier to the use of ‘light’ and weight reduction foods. A specific recommendation will usually be needed to drive sales in this category

Sales and loyalty

Lack of continuous supply has been an issue for many brands in 2022. That has sometimes been as a result of Brexit and problems importing products, rising transport costs and also issues within the supply chain itself resulting in shortages of packaging materials. Lack of raw materials on meat varieties which rely on the restaurant trade (such as duck and salmon) has also caused challenges particularly during lock down and post pandemic.

Brand loyalty is often high in this sector and switching often poorly tolerated by both the shopper and their pet. Around one third of shoppers say they would leave the store to shop elsewhere if their preferred dry dog food brand was

not available.

Passing on promotional offers on dog food to consumers can be a useful way to increase sales and attract new customers to a destination. This strategy can also provide a halo effect, so the store is seen as offering value for money across the board – given that price comparison on dog foods is relatively easy to do. As an important basket filler, dog food sales can be key to unlocking sales for multi-pet owners and across other categories.

Local sourcing, Made in Britain, traceability, sustainability, plant based diets and the inclusion of ‘superfoods’ are all said to be important drivers of consumer shopping behaviour in this sector.

Sources / further reading:

1. https://store.mintel.com/report/uk-pet-food-market-report

2. https://www.petfoodindustry.com/blogs/7-adventures-in-pet-food/post/11345-insect-protein-hype-or-hope-for-pet-foods-future

3. https://www.globenewswire.com/en/news-release/2022/09/07/2511638/0/en/Organic-Pet-Food-Market-is-expected-to-total-US-4-0-Billion-by-2032-at-a-CAGR-of-7-4-from-2022-2032-Future-Market-Insights-Inc.html